Managing personal finances has never been easier, thanks to the plethora of apps available today. Whether you’re looking to track your spending, save more effectively, or make smart investments, there’s an app tailored to your needs. Below, we compare some of the top personal finance apps that cater to a finance-savvy audience, helping you make informed decisions about your money.

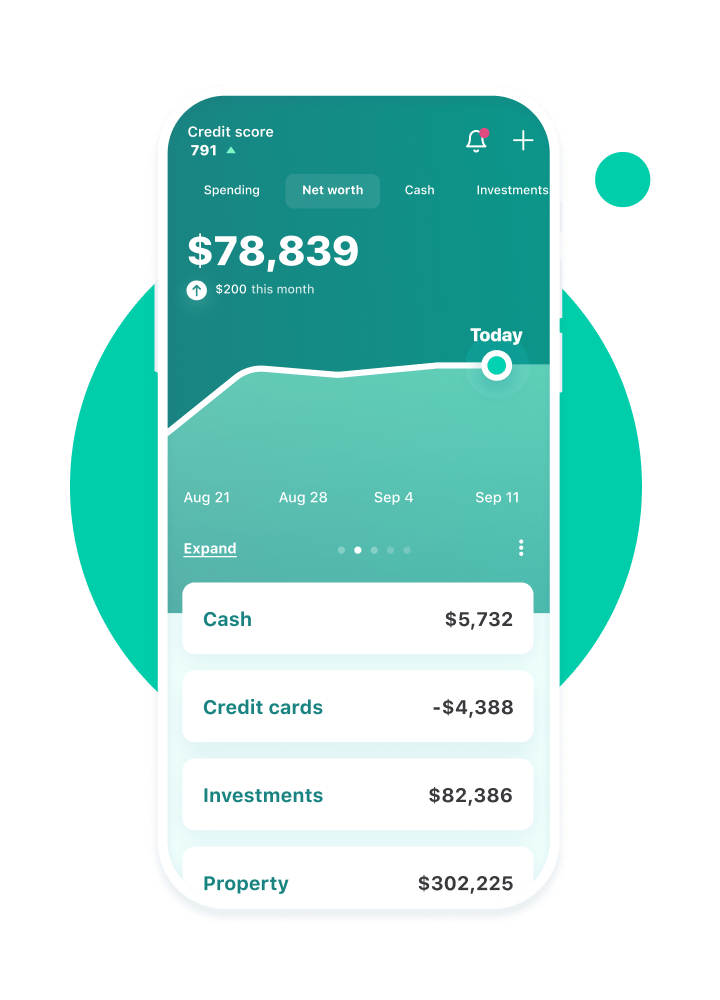

1. Mint

Best For: Budgeting and Expense Tracking

Mint is a well-known app that offers a comprehensive overview of your financial life. It automatically syncs with your bank accounts, credit cards, and even bills, categorizing your transactions and providing real-time tracking of your spending habits. The app also alerts you to unusual spending and upcoming bills, helping you stay on top of your finances.

Key Features:

- Budget tracking with custom categories.

- Free credit score monitoring.

- Bill payment reminders.

Pros:

- User-friendly interface.

- Wide range of financial tools in one place.

- Completely free to use.

Cons:

- Some users may find the ads intrusive.

- Limited investment tracking features.

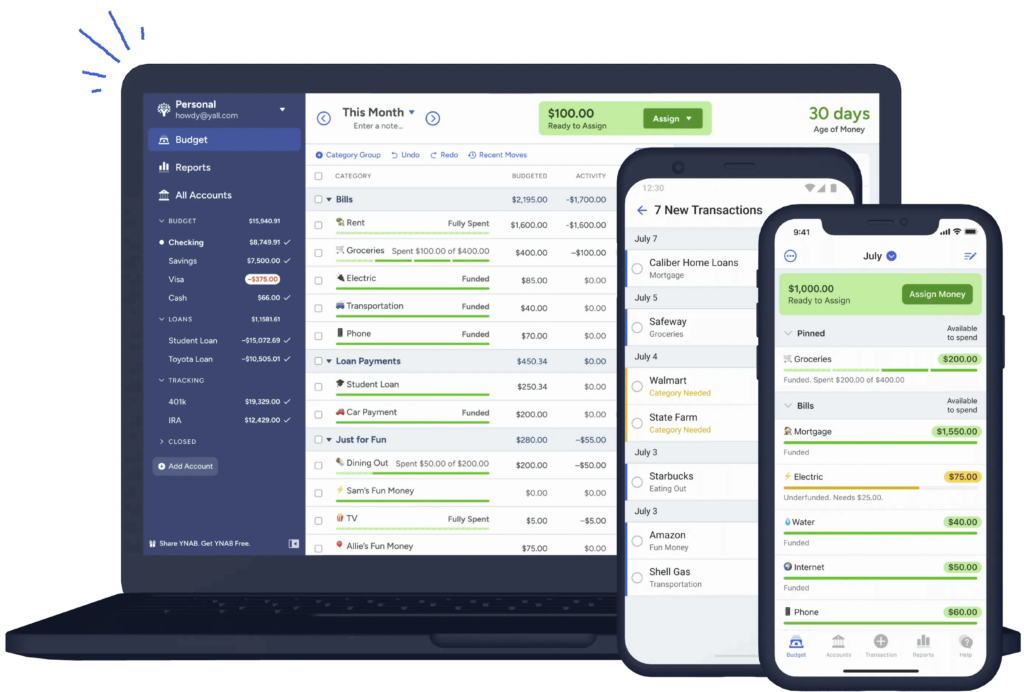

2. YNAB (You Need a Budget)

Best For: Hands-On Budgeters

YNAB is designed for those who want to take a more proactive approach to budgeting. The app operates on the principle of “giving every dollar a job,” encouraging users to allocate income to expenses, savings, and investments. YNAB’s focus on goal-setting and financial planning makes it ideal for users who want to control every aspect of their budget.

Key Features:

- Goal tracking for savings and debt payoff.

- Real-time syncing across devices.

- Extensive educational resources.

Pros:

- Strong emphasis on financial discipline.

- Excellent customer support and tutorials.

- Highly customizable budgeting system.

Cons:

- Requires a paid subscription.

- Steeper learning curve compared to other apps.

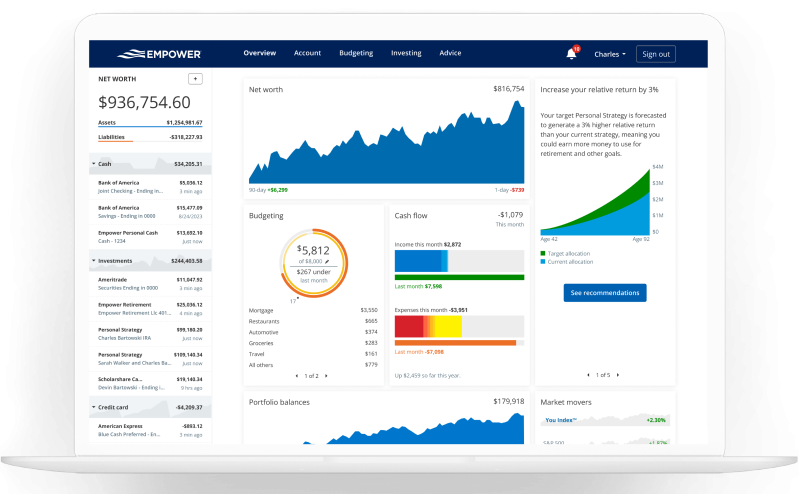

3. Empower

Best For: Investment Management and Net Worth Tracking

Empower stands out as a top choice for users who want to manage investments alongside their day-to-day finances. The app provides detailed insights into your portfolio, including asset allocation, fees, and performance tracking. It also offers retirement planning tools and a net worth tracker, making it a powerful tool for long-term financial planning.

Key Features:

- Comprehensive investment tracking and analysis.

- Retirement planning calculators.

- Fee analyzer to identify hidden fees in your investments.

Pros:

- Robust tools for investors.

- Easy integration with multiple financial accounts.

- Free wealth management tools with optional advisory services.

Cons:

- High minimum balance for wealth management services.

- Focuses more on investments than daily budgeting.

4. Acorns

Best For: Micro-Investing and Saving

Acorns is a unique app that rounds up your everyday purchases to the nearest dollar and invests the difference into a diversified portfolio. This “spare change” approach to investing is perfect for beginners who want to start investing without a large upfront commitment. Acorns also offers additional features like retirement accounts and a checking account.

Key Features:

- Automatic round-ups on purchases.

- Portfolio based on your financial goals.

- Educational content to improve financial literacy.

Pros:

- Easy way to start investing.

- Low minimum investment requirements.

- Additional savings tools and educational resources.

Cons:

- Monthly fees can be high for small balances.

- Limited control over specific investments.

5. Honeydue

Best For: Couples Managing Finances Together

Honeydue is tailored for couples who want to manage their finances together. The app allows partners to track expenses, budget, and even chat about finances within the app. Honeydue’s focus on transparency and collaboration makes it an excellent choice for couples who want to align their financial goals.

Key Features:

- Shared budgeting and expense tracking.

- Bill reminders and alerts.

- In-app messaging for financial discussions.

Pros:

- Designed specifically for couples.

- Free to use with no hidden fees.

- Encourages open communication about money.

Cons:

- Limited investment and savings tools.

- Some features may overlap with other apps you’re already using.

Find Your Fit

The best personal finance app for you depends on your financial goals and how hands-on you want to be with your money. Whether you’re looking to track every dollar, start investing, or manage finances with a partner, there’s an app on this list that can help you achieve your objectives. Explore these options and choose the one that best aligns with your financial strategy.

By leveraging these tools, you can gain better control over your finances, make informed decisions, and work towards your financial goals more effectively.